How can I be exempted from paying the Spanish plastic tax?

Demonstrate reusability or incorporate recycled material into your packaging

In January 2023, the tax on the manufacture, import or intra-Community acquisition of non-reusable plastic packaging incorporating virgin plastic came into force. This is the so-called “plastic tax”, which is included in the Spanish Law on Waste and Contaminated Land for a Circular Economy, and which will levy a tax of 0.45 euros/kilogramme on non-recycled plastic content in non-reusable packaging.

This law is not the only one that will regulate recycled plastic or the reuse of packaging, as the Spanish Royal Decree on Packaging and Packaging Waste also does so. Therefore, the big question for the industry at the moment is how to achieve exemption from paying the plastic tax and how to comply with all the requirements and percentages that the new rules establish? We make a breakthrough: by demonstrating the possibility of reuse or the incorporation of recycled material.

If you want to know what are the key aspects of the current legislation and how to face as a company all the changes that are coming, both with the Waste Law and with the imminent approval of the draft Royal Decree on Packaging and Packaging Waste, keep reading this article in which we will discuss:

1. Latest news on the plastic tax (updated January 2023)

2. Market data: virgin and recycled plastic production.

3. What does the industry think about the plastics tax?

4. Does the plastics tax affect my company?

5. Business strategies to comply with the draft Royal Decree on Packaging and Packaging Waste.

6. How can I prove that a packaging is reusable?

7. How to prove the recycled content of packaging?

8.

1. Latest developments in the plastic tax of the Law on Waste and Contaminated Soil for a Circular Economy.

On 30 December 2022, Order HFP/1314/2022 of 28 December was published, which regulates the formal obligations of the tax on non-reusable plastic packaging. The Order

- Form 592 “Special tax on non-reusable plastic packaging. Self-assessment” and A22 “Special Tax on non-reusable plastic packaging. Request for refund” and the form and procedure for their presentation are determined.

- Registration in the Territorial Register and the characteristics of the plastic identification code (CIP), which must be obtained for each of the activities and, in the case of manufacturers, also for each establishment in which the activity is carried out, are regulated. The plastics tax comes into force on 1 January 2023, but registration in the Territorial Register can be made during the following 30 calendar days.

- The requirements relating to the keeping of accounts and the registering of stocks are also regulated.

In addition, the Tax Agency has documents and virtual tools available for taxpayers who must pay this tax:

- A note on registration in the territorial register informing that from 1 December those who are obliged to register in this register will be able to apply for it through the electronic Headquarters of the State Tax Administration Agency. It also specifies who is obliged to register, what documentation must be provided and how to carry out the appropriate procedures.

- The presentation with the Webinar “Special tax on non-reusable plastic packaging” organised by the Tax Agency on 21 November.

- Virtual tools: The Tax Agency has created a digital assistant for requesting appointments or making queries. It has also created an informer on the special tax on non-reusable plastic packaging, which provides general information on the most important aspects of the new tax, where users can choose the options that apply to them from different drop-down menus.

- At the beginning of October, the Tax Agency’s website published new explanatory documents for the management of the tax:

- New documents to submit to the Inland Revenue: In April 2022, the Draft Ministerial Order was published which included the models of documents to be submitted to the Inland Revenue by taxpayers subject to this tax. If you would like to consult the forms for self-assessment, refunds and record keeping, you can consult them at:

- Tax Agency simulator: An online tool has been created that consists of a test environment for simulating the management of the tax.

2. Market data: production of virgin and recycled plastic.

A total of 50.3 million tonnes of virgin plastic were produced in Europe in 2021, of which 7.5% was generated in Spain, according to the Plastics, the facts 2022 report by PlasticsEurope, which brings together data from the 27 countries of the European Union together with those of Norway, Switzerland and the United Kingdom. According to the report, the packaging sector (with 39.1% of the 50.3 million tonnes) and the construction sector (21.3%), followed by the automotive sector (8.6%), were the sectors with the highest demand that year.

Regarding end-of-life, in 2020, 35% of post-consumer plastic waste was sent for recycling (in Spain, 43%). On the other hand, only 2.9% of the plastic material used in the European packaging sector in 2021 was post-consumer recycled content.

3. What does the industry think about the plastic tax?

And how does the industry view the upcoming plastics tax? In Alimarket’s survey on the packaging situation in 2022, 76.6% of respondents had a very negative perception of the influence of a plastic packaging tax on the development of their business, with 38.7% believing that it will have a very negative effect.

As to how the measures to make the use of reusable packaging compulsory will influence the development of the business activity, 40% believe that it will be somewhat detrimental, compared to 30% who think it will benefit them, and 27.6% who think that it will not affect them (27.6%).

What is clear is that the industry is on tenterhooks as to how to deal with the changes ahead. Sustainability of packaging is no longer an option, it is a legal obligation and compliance affects not only the manufacture of packaging, but also its end of life and waste management.

4. Does the plastics tax affect my company?

The new tax affects companies that use or manufacture non-recycled plastic containers or packaging that are not reusable. Semi-finished products used to obtain packaging (preforms or sheets) and objects used to close, market or present packaging (caps, stretch film, strapping, etc.) are also subject to the tax.

The only exceptions to the payment of the tax for manufacturers, purchasers or importers of plastic containers and/or packaging is if it affects medical devices, special medical uses, infant formula or hazardous waste of medical origin, although this must be justified.

5. How to prove that a packaging is reusable?

ITENE supports companies to demonstrate that their packaging is reusable. To do so, we follow the UNE-EN 13429:2005 standard “Packaging. Reusability” as a technical reference document. Furthermore, in the event that the packaging is not yet reusable, our research centre helps to develop and implement those aspects that are necessary to be able to consider that the packaging is reusable, both from the point of view of the design of the packaging and the reconditioning, refilling/reloading and reuse systems.

If you want to know more about how to assess whether a packaging is reusable and, if it is not, how to implement the necessary changes in its design and develop packaging reuse systems, please consult this page.

6. How to demonstrate the recycled content of packaging?

As mentioned above, the Spanish Law on Waste and Contaminated Land for a Circular Economy introduces a tax on non-reusable plastic packaging of 0.45 euros per kg of non-recycled material. Companies will be able to exempt themselves from paying the tax on recycled material content, but this will require supporting information to be submitted to the Tax Agency.

In addition, it should be noted that in 2023 it will be sufficient to provide a declaration of responsibility from the supplier of the material, but in 2024 a certification of the recycled content will be required.

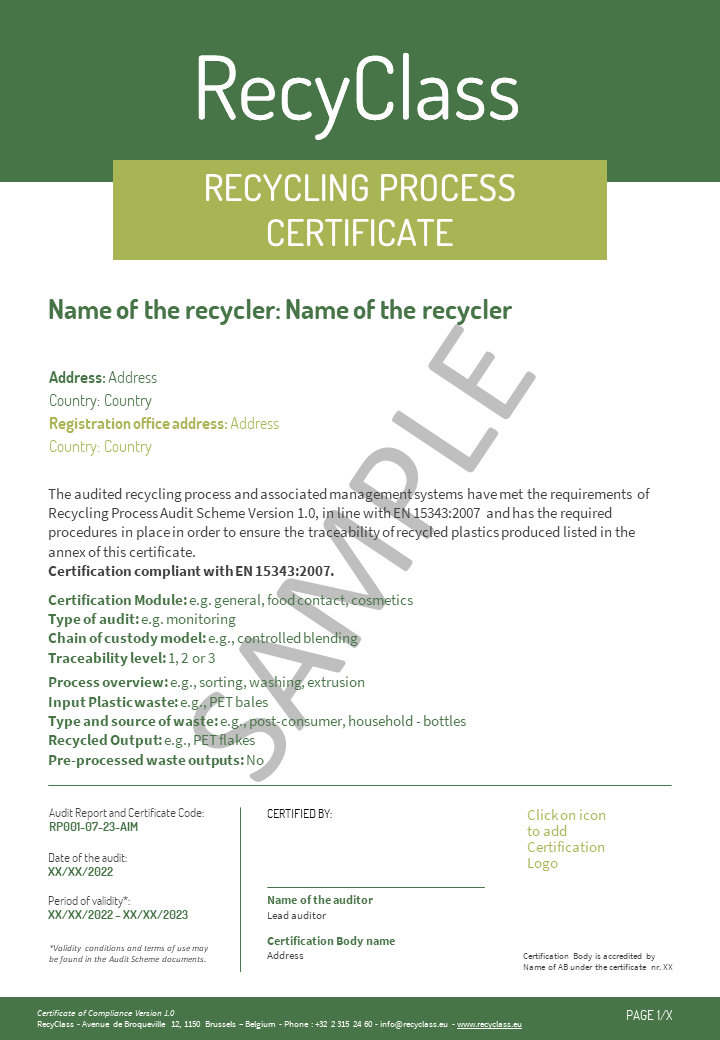

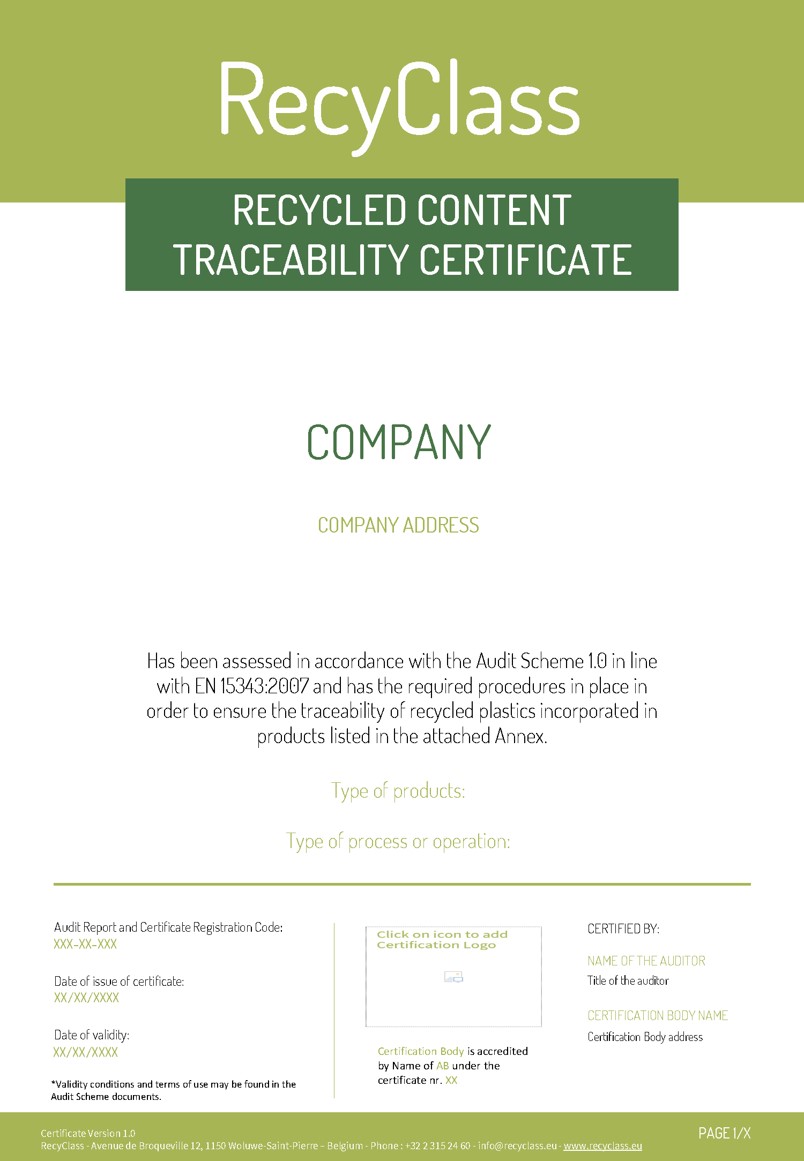

To prove the recycled content of a packaging, ITENE takes into account the requirements of the UNE-EN 15343:2008 standard on traceability and conformity assessment of recycled content and recycled content, standard on which one of the RecyClass certifications is based. ITENE is a certifying body accredited by this non-profit and cross-sectoral organisation promoted by the European association Plastics Recyclers Europe.

In this way, ITENE experts audit recyclers to demonstrate the conformity of the traceability of recycled plastics within a process and to verify the percentage of recycled plastic content in the products.

Recyclass certifications, which can be issued by ITENE, analyse the whole chain involved in the management of recycled plastic material, from its origin, and are granted to products that have been manufactured during the last 12 months with pre-consumer or post-consumer recycled plastic.

To find out more about how we can help you demonstrate the percentage of recycled plastic content and certify the recycling process, as well as discover our packaging recyclability assessment services, please visit this page.

7. How to demonstrate recyclability?

ITENE has been recognised by RecyClass as the first laboratory in the world accredited to demonstrate the practical recyclability of polystyrene (PS) containers through the “RecyClass Recyclability Evaluation Protocol for PS Containers“.

This is a harmonised methodology for testing the recyclability of a specific product in a given recycling stream. PS resins, PS products containing barrier materials, mineral fillers and additives, PS-free closure systems, non-PS coatings, liners and valves, PS-free labels and sleeves, adhesives and inks can all be accredited under this protocol.

ITENE also offers theoretical recyclability assessment services for plastics according to UNE-EN 13430:2004.

8. Business strategies to comply with the draft Royal Decree on Packaging and Packaging Waste

In Spain, the Royal Decree on Packaging and Packaging Waste, also introduces requirements for the introduction of recycled material and the reuse of packaging.

To begin with, a guiding principle of this regulation is that packaging marketed in Spain should be recyclable by 2030 and, where possible, reusable.

Thus, we find some ambitious targets for the recyclability of packaging, such as achieving 65% recycling of packaging by 2025 and 70% by 2030. Regarding the introduction of recycled content, by 2025 PET packaging should contain at least 25% recycled plastic and non-compostable plastic packaging other than PET should contain at least 20% recycled plastic. By 2030, plastic packaging should, in general, contain at least 30% recycled plastic, although specific percentages are set for each packaging type.

Other examples of targets found in the draft refer to the reuse of packaging, such as:

- Reuse of packaging from the HORECA beverage channel (50% in 2025 for soft drinks).

- Reuse of domestic beverage packaging (10% by 2025).

- Reuse of household packaging of different beverages (5% in 2025).

- Reuse of commercial and industrial containers of different beverages (40% by 2025).

- Reusable packaging may be provided at the point of sale or consumers may use their own packaging.

In this regulatory context, the solution for companies to meet the new regulatory requirements is to demonstrate the reusability or recycled plastic content of the packaging.

-

Shall we talk?

César Aliaga

Head of Packaging and Circular Economy Unit at ITENE